Digital transformation is under way and it’s changing the industry. One of the necessary conditions for successful transition is closer cooperation between marketing and finance leaders. In this article you’ll learn what causes most disagreement and where they should find more common ground.

In June 2019, Ernst & Young published a report about potential that cooperation between CMOs and SFOs has. In the age of digital transformation, MarTech helps businesses better understand their clients, track activity along the customer journey, stimulate growth, and analyze data to provide insights for marketers. They use everything that new technology and data offer to invest smarter, increase customer loyalty and retention, and adopt a customer-focused approach to marketing. To successfully implement this data-driven approach, they need significant investments, which should be approved by CFOs who want to hear a strong business case and see ROI forecasts before making any decisions. That’s why collaboration and better dialogue between the two functions is crucial in the age of digital transformation. According to Ernst & Young survey of 304 C-level managers in finance and marketing, 90% think that these departments need to be more involved into one another’s activities, and 83% believe that this cooperation will improve their company’s marketing performance.

In the report E&Y covers the challenges that CMOs and CFOs face when trying to work together and gives some advice on how to find more common ground and benefit from it. About 70% of the survey respondents point out that the differences between the two departments have even become more striking recently, but the positive news is that they see the need for cooperation and are willing to work on it because they understand that it’s crucial to build a healthy marketing-finance dynamic. It’s a good idea to invite CMOs to take part in finance meetings to get them involved, help understand how everything works. Together they can use all the benefits of data-driven marketing and create long-term value. According to the survey, 90% of CMOs and CFOs believe that digital transformation requires more cooperation from them, and about 50% think their relationship is less productive than between other departments. There are several factors that might explain why the differences, that prevent healthy cooperation, exist and where they come from.

1. Different business growth priorities

Their ideas about the main priorities for business for the nearest future are not the same: while finance leader focus on business growth, marketers pay more attention to customer acquisition and engagement. In the table below you can see the top priorities for CMOs and CFOs. They both consider such factors as brand awareness and more effective data use to be important, but assign different level of importance to them. But the last point is more demonstrative, as these competing priorities show that the two departments have different vision of the business overall.

| CMOs | CFOs |

|

1. Improving relationships with customers (45%) 2. Raising brand awareness (41%) 3. Driving better insight from data (39%) 4. Getting the right skills/talent (35%) 5. Creating a more open and inclusive culture (31%) |

1. Driving better insight from data (43%) 2. Improving relationships with customers (38%) 3. Raising brand awareness (34%) 4. Getting the right skills/talent (34%) 5. Reducing costs/increasing efficiency (31%) |

| CMOs |

|

1. Improving relationships with customers (45%) 2. Raising brand awareness (41%) 3. Driving better insight from data (39%) 4. Getting the right skills/talent (35%) 5. Creating a more open and inclusive culture (31%) |

| CFOs |

|

1. Driving better insight from data (43%) 2. Improving relationships with customers (38%) 3. Raising brand awareness (34%) 4. Getting the right skills/talent (34%) 5. Reducing costs/increasing efficiency (31%) |

2. A disconnect on data

Marketing has become increasingly data-driven and focused on ROMI. High quality data allows making more accurate forecasts, but requires significant investment. Both functions agree on the importance of data and the right skills and experience to handle it, but they have different opinion about the effective use of data and analytics, especially if you take into account recent privacy regulations that affected the use of data in marketing.

3. Varied tenures

Usually CMOs last much shorter than CFOs, which gives the latter more opportunities and power. They know more about the company itself and have longer relationship with the board. CMOs don’t have this opportunity and need first to earn the trust of the board and investors to ask for substantial funding. Finance leaders, who know more, should update newcomers on the company’s marketing activity and previous practices.

CMO’s are often seen as the new kid trying to get greater funding – that’s a hard thing for anyone to do

Dan Carter, former CFO of a $500 million-plus public company

4. Mismatched timescales

Marketing and finance work with different timescales: CFOs work with the past events, wile CMOs have to work with real-time events and react to them. They also see investments differently because a company expects more immediate results from the finance department, while marketing sees the results later. Marketers need to track customers’ mood and react to any changes, which can be successfully done with the support of CFOs. Despite all the differences both functions understand the importance of their collaboration for a successful digital transformation and are open to it.

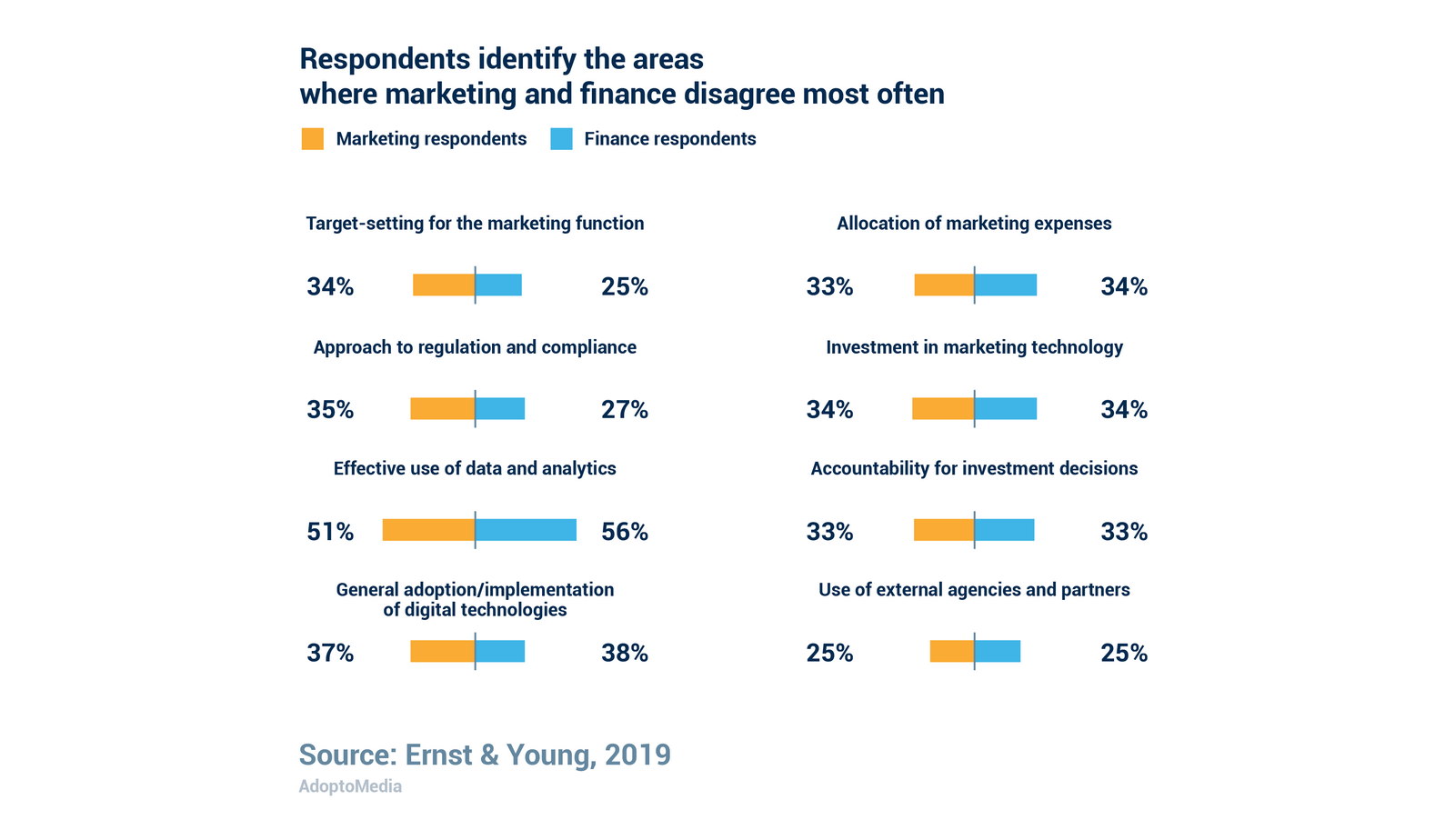

Here are areas that cause the most tension and require efforts from each team to work more effectively.

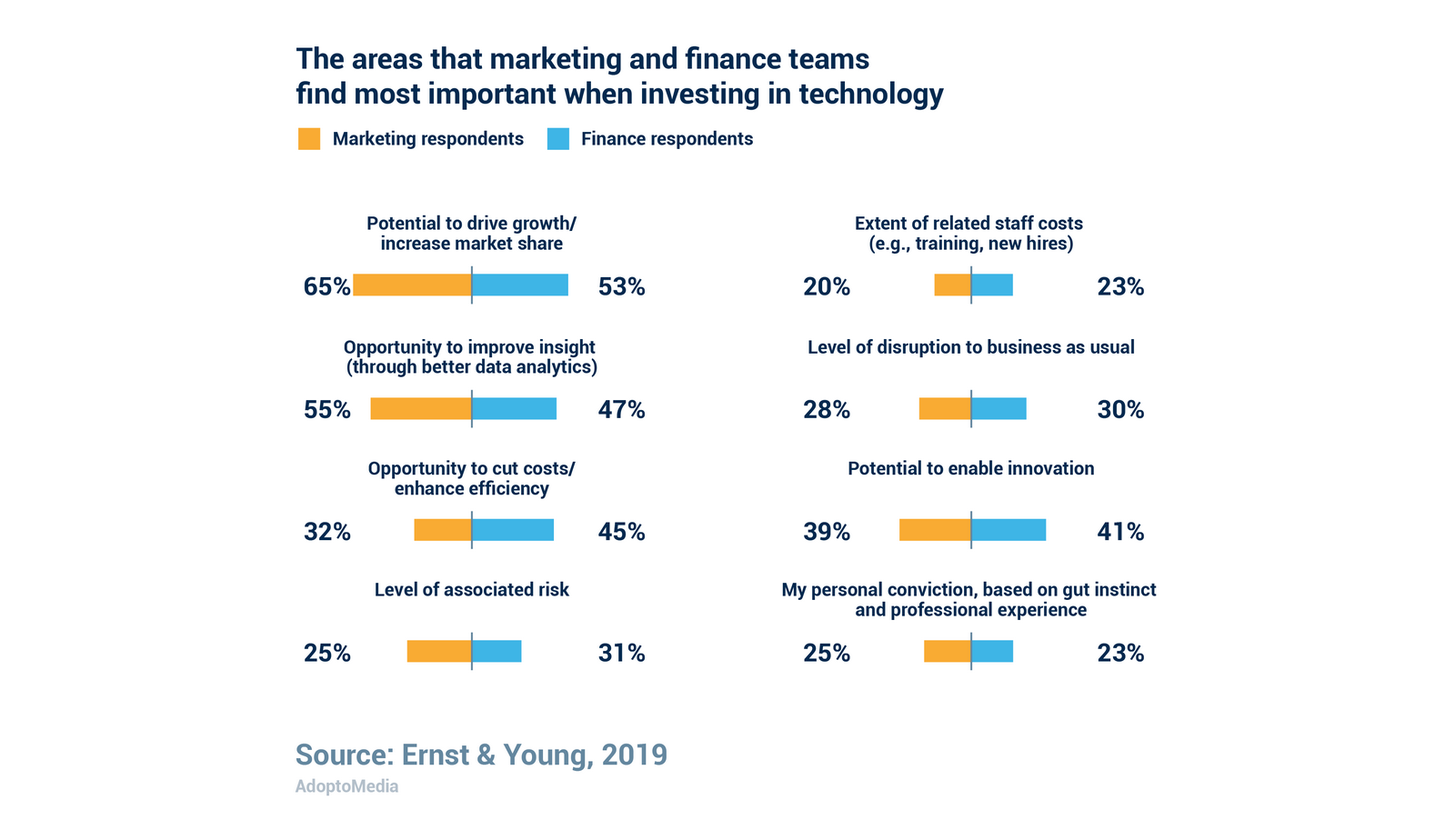

1. Different approaches to MarTech

According to Gartner’s 2018-2019 CMO Spend Survey, marketers spend up to 29% on technology now. Developing MarTech and data gives them more opportunities to engage customers, ensure new growth and drive better insight. However, to secure the necessary funding, they first need to discuss it with finance department, which evaluates cost efficiency and potential risks before allocating funds. This can make it challenging to convince CFOs of the need for investments in specific MarTech solutions. Consequently, both functions need to find more common ground in budget allocation.

CMOs can address this issue by introducing one technology at a time rather than trying to implement everything at once, which could put financial resources at risk. They should focus on the desired business outcomes and select suitable technologies, ensuring that the transition to new tech does not disrupt the existing processes within the company. CMOs need to estimate whether the new technology will generate enough ROI and explain to the CFO all the advantages it will provide. The two departments also use different sources of information to estimate the positive and negative influence that new tech might have on the company. CMOs usually turn to external sources, such as consultants, partners and suppliers, while CFOs prefer internal resources.

Another obstacle to approval process is different tenure length between CMOs and CFOs. Marketing investments usually pay off over the long term, so CMOs are not always there to see the results of their decisions. Another difference between them is that marketers are more open to risks and ready to explore new, untried technology, while finance leaders are more conservative and cautious. CMOs need to learn to talk about tech spend with CFOs and explain the reason for investment in detail, they also need to communicate on a regular basis not just discuss budget allocation. And CIO should join too and provide technical knowledge for a complete picture to simplify the decision-making process.

2. Conflicting metrics for ROI and performance

Management sometimes views marketing expenditures as the most logical area to cut because it is not always clear how to demonstrate their value and measure their effectiveness and productivity. This problem is topical as ever, for example, IAB wrote a guide on how to use cross-media measurement tools to calculate the effectiveness of advertising. ROI measurement causes a lot of tension between CMO and CFO. Marketers need to convince CFOs that an investment will generate positive ROI, and even if they do, it’s always a risk in a way, because it’s impossible to forecast everything, and CFOs need hard facts, which cannot always be provided. Finance leaders want to make CMOs a part of the decision-making process, which will make them more accountable for the results. It may not be very comfortable for marketing leaders, but it’s a way to control marketing investments, and CIOs must also be involved to act like a guardian.

Despite the differences there are things that they agree on when it comes of measuring marketing effectiveness, such as return on total marketing and customer investment and brand awareness, the only difference is that marketers focus on qualitative data, while CFOs focus on quantitative data. So it turns out that finance department pushes marketers to find answers to questions about their effectiveness. It’s necessary now to find the right balance between the two approaches, and they have to act quickly because more than 60% of both groups are worried that new technology might become outdated even before providing ROI growth.

3. Changes to data privacy and regulation

After the California Consumer Privacy Act and the European Union’s General Data Protection Regulation (GDPR) were passed, privacy regulation became a topical issue, and that’s another point where CMOs and CFOs disagree. About 70% of respondents agree that compliance with the new regulations is a concern that might affect their business, and this factor will become even more threatening in the future. About half of them think that it is crucial to minimize the influence of privacy regulations on sales and marketing activity. If regulations become stricter, it will influence what data businesses are allowed to collect and share, and which records they have to destroy. It will make ROI forecast even more difficult and uncertain, which will complicate investment approval.

Both functions think that there are three main challenges in achieving compliance:

1. Keeping up with frequency of updates and changes, which is especially true for marketers, who now have to constantly learn new things;

2. Having total understanding of all data location within the company;

3. Having total understanding which data is held in the company.

Marketing and Finance collaboration will benefit everybody, because it’s the key to success, and CEO should support them both and try to connect them and create better conditions for cooperation, for example set common metrics in the company. Marketers have taken on new responsibilities and functions lately, and they need to work closer with CFO, because the right investment can create short- and long-term value.

Here are key takeaways for both functions.

| CMO | CFO |

|

|

| CMO |

|

| CFO |

|

Companies that manage to create the right and healthy dynamic between the two departments will successfully perform digital transformation and benefit from the data-driven marketing. And AdoptoMedia can help to perform this digital transformation process smoothly. Our flexible platform can be integrated into existing IT infrastructure of a company to achieve the necessary level of transparency in cross department operations, verify compliance, manage contracts, provide visibility of numerous operations for C-level executives and set common KPIs, which will simplify the cross-department collaboration and decision-making process. AdoptoMedia offers a new tool for strategic and tactical assistance in marketing, that increases ROMI by at least 10-20% and calculates it in real time. With our tool, marketers can effectively demonstrate the financial outcomes of their campaigns, including sales volume or the number of new customers, rather than relying solely on internal metrics that may seem irrelevant to the finance team. This not only enhances dialogue between CMOs and CFOs but also simplifies their collaboration, ultimately driving better results for the company.