As we have previously covered here and here, the 2016 “RebateGate” proved to be a wake-up call for the advertising industry enshrouded in non-transparency, and uncovered the disconnect between the advertisers and their agencies in regards to the very nature of their relationship. The Association of National Advertisers, which commissioned the renowned K2 Intelligence Report, was quick to lend a helping hand to advertisers who found themselves at a loss as to how to cut their losses and recuperate. Published in July 2016 and updated to version 2.0 in July 2018, ANA’s template Master Media Buying Services agreement is part of the overall set of ANA’s Guidelines for best practice. It is meant to serve as a blueprint for transparent regulation of the Advertiser-Agency relationship, ultimately aimed at rebuilding trust and confidence between the two parties.

As we have previously covered here and here, the 2016 “RebateGate” proved to be a wake-up call for the advertising industry enshrouded in non-transparency, and uncovered the disconnect between the advertisers and their agencies in regards to the very nature of their relationship. The Association of National Advertisers, which commissioned the renowned K2 Intelligence Report, was quick to lend a helping hand to advertisers who found themselves at a loss as to how to cut their losses and recuperate. Published in July 2016 and updated to version 2.0 in July 2018, ANA’s template Master Media Buying Services agreement is part of the overall set of ANA’s Guidelines for best practice. It is meant to serve as a blueprint for transparent regulation of the Advertiser-Agency relationship, ultimately aimed at rebuilding trust and confidence between the two parties.

The advertiser-agency media management practices require full disclosure as their cornerstone principle. Seeing how many agencies have blurred the lines, the contract between the parties has to precisely define the nature of their relationship. Whether it be that the agency acts as the client’s agent or the principal in its own right, there should always be a contractually prescribed ability for the advertiser to “follow the money” and be informed of any and all instances where rebates and otherwise concealed incentives come into play. Additionally, transparency must not be limited to the media buying aspect of the relationship; it must also encompass the client’s control over the advertising performance of the purchased media.

If we look once again here at the ANA template agreement, its Item 6.3 explicitly prohibits non-disclosure of potential conflicts of interest as pertains to consulting, research or any other service agreement between the agency and the media owner. Considering the fact that agencies present to the client econometric-model-based projections of ad campaign performance, this falls both under the category of research as per item 6.3 and pertains also to item 6.4 which prescribes that all recommended media plans be free of such conflict of interest. Furthermore, items 2.3 and 5.2.1 of the agreement oblige the agency to present the client with a media planning instrument that would be free of the conflict of interest and which would help project the performance of the ad campaign. Previously, agencies used to implement econometrics in their favor, presenting to the client the final “result” without actually showing the possible behind-the-scenes adjustments made to the formula to go in line with their margin/rebate incentives.

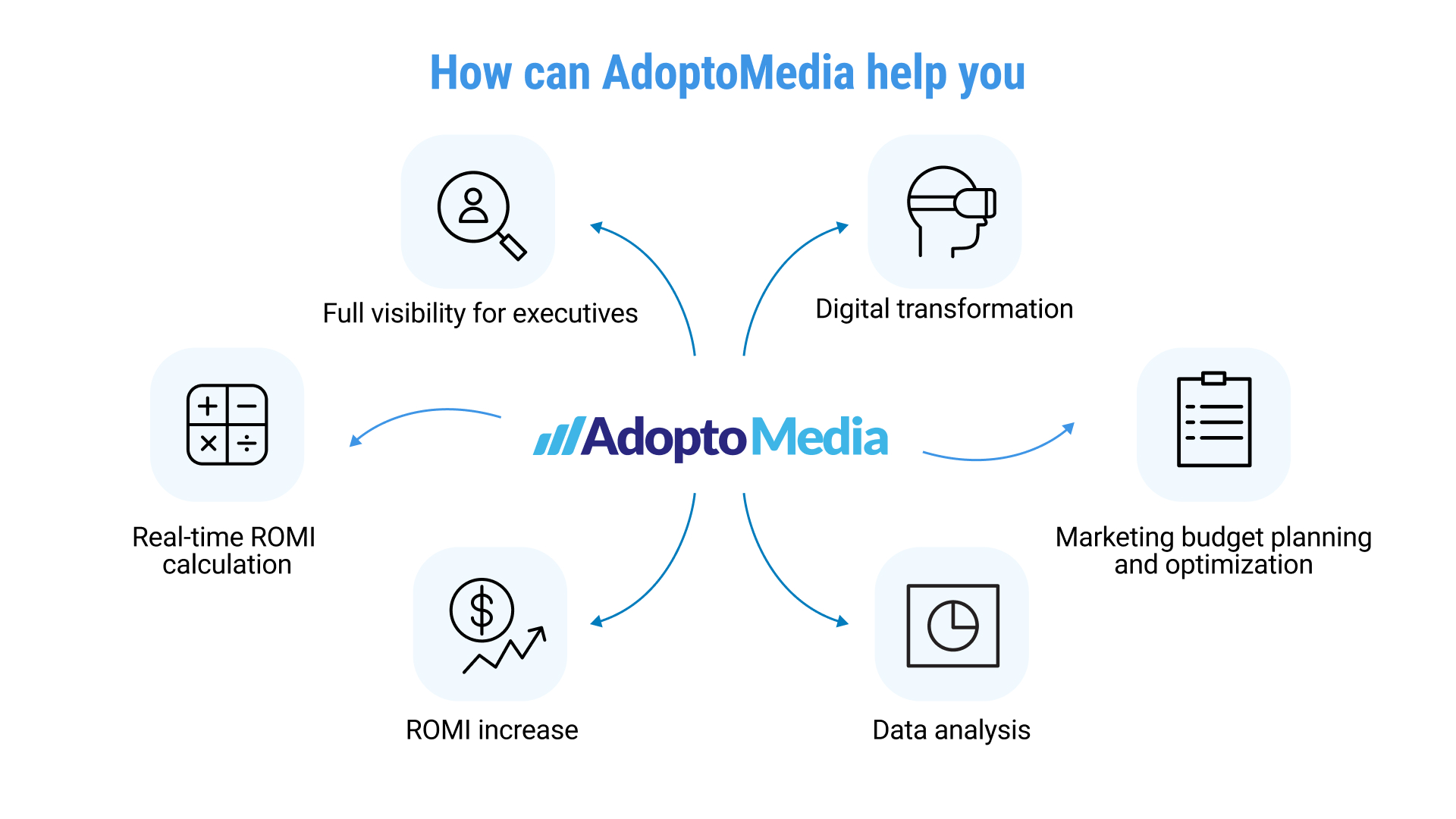

To counter this, AdoptoMedia offers a tool that can supervise the efficiency of advertising in-house. This option has been in increasing demand, as shown by brand powerhouses Puma and Procter & Gamble. By allowing the client to adjust their media mix, our platform proves to be an effective tool in regularly meeting the client’s target KPI’s and achieving a substantial ROMI improvement of 17% on average.

To counter this, AdoptoMedia offers a tool that can supervise the efficiency of advertising in-house. This option has been in increasing demand, as shown by brand powerhouses Puma and Procter & Gamble. By allowing the client to adjust their media mix, our platform proves to be an effective tool in regularly meeting the client’s target KPI’s and achieving a substantial ROMI improvement of 17% on average.

Since the only way to decisively ensure transparency when using econometric modeling is to be able to deal with clear and auditable algorithms, AdoptoMedia platform delivers just that. Provided as supervisable software and not a consulting service, it is as far removed from being a “black box” as possible. Based on Big Data and AI algorithms, the suite provides the entire range of media budgeting capabilities. With AdoptoMedia, clients get a one-stop solution for allocating media budgets, executing media plans and adjusting projected media budgets based on actual media spends. This, in particular, can decrease the time needed to adapt to market challenges by more than 45%.

In an industry prior arguably dominated by informational grey areas, there is now a readily available auditable software option that can support and accelerate transparent and data-driven decision-making and bring about true marketing automation with the client retaining full control.