In 2016 the marketing industry community was shaken by a major event with potentially massive and all-encompassing repercussions. Aptly named “RebateGate”, the cataclysm was caused by an eye-opening report on media transparency in the advertising industry. The independent research behind it was commissioned by the Association of National Advertisers (“ANA”) and conducted by K2 Intelligence LLC (“K2”), leading the fact-finding part of the study. Addressing the study’s results, Ebiquity/FirmDecisions (“Ebiquity”) partnered with K2 to develop specific applicable advice and recommendations to help advertisers adjust to this newfound information and address the potential blind spots.

In 2016 the marketing industry community was shaken by a major event with potentially massive and all-encompassing repercussions. Aptly named “RebateGate”, the cataclysm was caused by an eye-opening report on media transparency in the advertising industry. The independent research behind it was commissioned by the Association of National Advertisers (“ANA”) and conducted by K2 Intelligence LLC (“K2”), leading the fact-finding part of the study. Addressing the study’s results, Ebiquity/FirmDecisions (“Ebiquity”) partnered with K2 to develop specific applicable advice and recommendations to help advertisers adjust to this newfound information and address the potential blind spots.

Throughout the process, K2 put out requests for interviews, reaching out to 281 sources, finally conducting 143 interviews with 150 separate sources, which amounted to a cross-section representation of how the United States’ media buying ecosystem operates. Throughout the study, all of the interviewed participants’ identities were kept secret from both the ANA and Ebiquity, including all the individuals and corporate entities named in the sources’ accounts. Additionally K2 held full authority over the methodologies the study team applied, also having editorial control over how the report was eventually presented.

What K2 realized was that within that sample they studied, there were pervasive non-transparent business practices. Out of the 117 sources directly involved in media buying, 59 attested to having had directly experienced non-transparency in business practices, such as rebates (which 34 sources confirmed) and potentially problematic practices arising out of principal transactions. Some even reported multiple instances of both of these, meaning the same source witnessed both rebates and troublesome principal transactions.

What is important to note here, is that such practices weren’t inherently specific to just one type of agency. There was enough evidence suggesting this was also in place in agency holding companies as well as some independent agencies. As for the nature of said evidence, it comprised both detailed accounts by the sources and substantial documentary evidence.

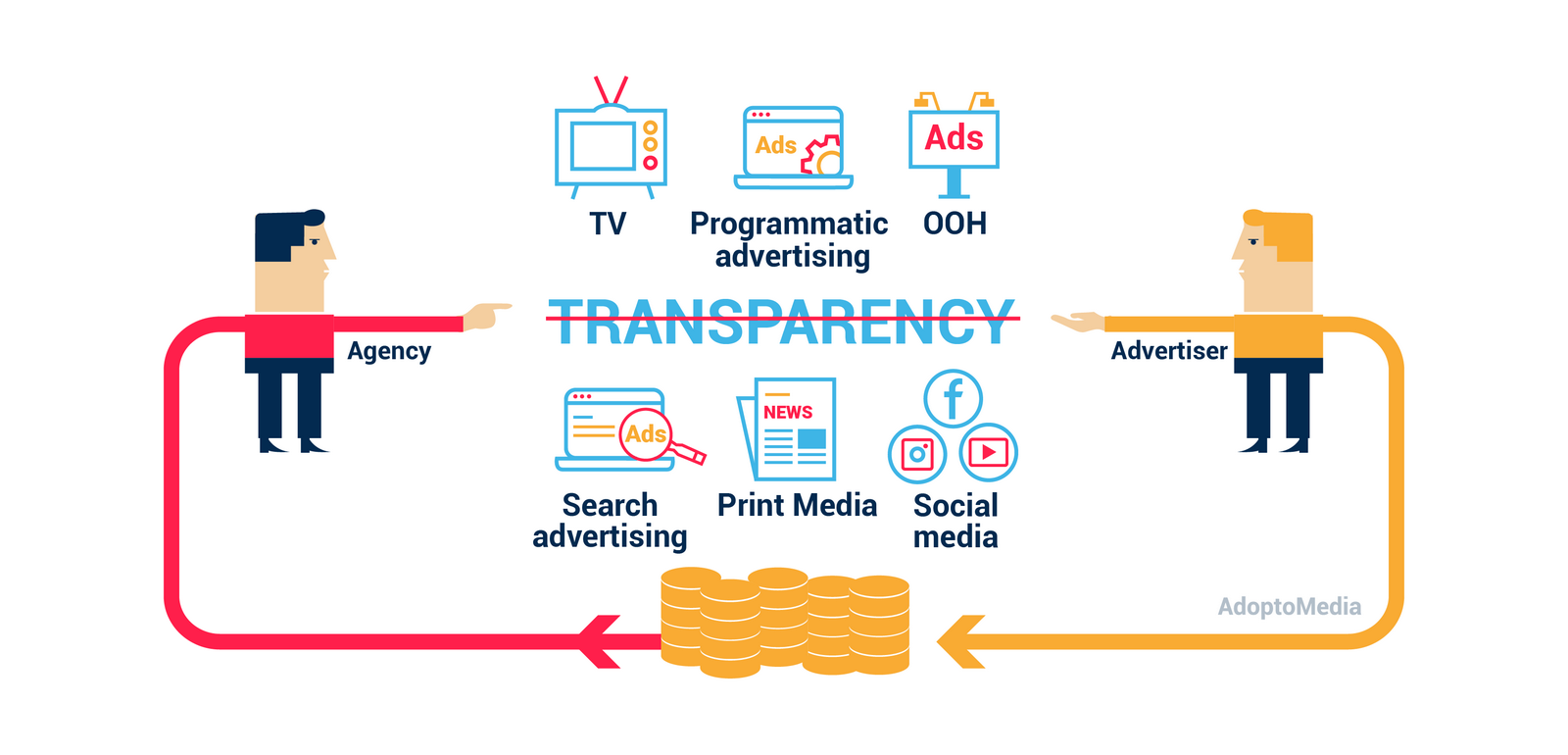

Same went for the types of media. Non-transparency was found across the whole media spectrum: digital, print, television and OOH. What is also troubling, is that some of the specific instances of the mentioned non-transparency displayed a systemic nature, appearing to be in place during the regular course of business. In particular, there was evidence that high-ranking agency and holding company executives were informed of said non-transparent practices and even mandated some of them. Additionally, evidence pointed to the fact that agency executives negotiated and sometimes signed contracts governing rebates and other concealed practices. It can be concluded that the pervasive nature of these practices is a strong suggestion of the fact that they are commonplace in the media-buying ecosystem serving as the source for the study sample.

There was abundant evidence attesting to rebate deals existing as a common non-transparent business practice in the U.S. market, as reported by 41 sources interviewed by K2. 34 of said sources conveyed indications that no such rebates were disclosed to advertisers, passed through to them and/or demanded by agencies. In addition, corroborating documentary evidence was uncovered, such as emails and contracts between media suppliers and media agencies. Collectively, this indicated a variety of instances where rebates were paid to agencies or their affiliates, amounting from 1.67% to 20% of the total media spend, depending on the particular deal. Several cases also suggested rebate percentage went up as did the agency spend.

These behind-the-scenes rebate deals were structured around financial incentives, such as cash or free media, while some sources also mentioned they took the form of service agreements tying the amounts of service fees (usually for consulting or research) to how much the agency spent. To top it off, such services were next to non-utilizable, much overpriced or not even provided in the first place.

These behind-the-scenes rebate deals were structured around financial incentives, such as cash or free media, while some sources also mentioned they took the form of service agreements tying the amounts of service fees (usually for consulting or research) to how much the agency spent. To top it off, such services were next to non-utilizable, much overpriced or not even provided in the first place.

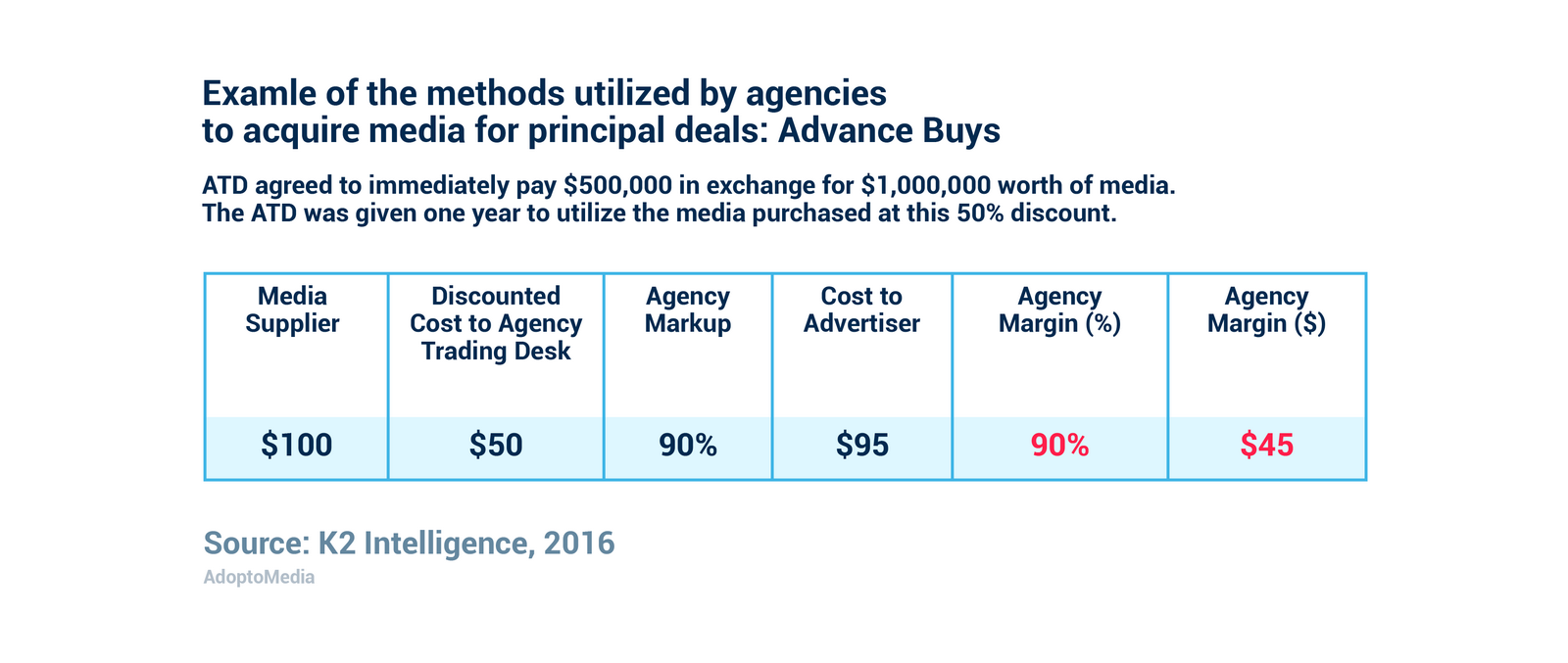

The study helped uncover through evidence that the murky nature typical of principal transactions often was bad news for the advertisers, since agencies took advantage of that by engaging in problematic conduct that was not in the advertiser’s best interest. To clarify, many contracts entered into by the advertiser and the agency have so-called “opt-in provisions” permitting the agency to engage in specific principal transactions with advertisers, where an agency holding company would play the role of a media supplier, buying media on its own behalf, later reselling it at a higher price. At the same time, when an agency that is part of such a holding company then sells said media to the advertiser, it does not disclose the original purchase price, along with other likely relevant info. Such price markups reportedly varied from approximately 30 to 90 percent, while media buyers are sometimes under pressure and/or incentive from the agency holding companies to direct the advertiser’s spend to said media, even if such purchases are not optimal for the client or aren’t in their best interest.

As for the reasons behind some of this behavior, there is evidence to suggest much of it is caused by the fact that agencies hold equity stakes in media supplier companies. Several former high-ranking agency employees mentioned being pressured by their higher-ups at agency groups or holding companies to make sure spend is directed to the company where the former have equity investments.

Notably, the study also proves that as of the time of the research mentioned, there is no real consensus as to the fundamental nature of the relationship between advertisers and agencies. In short, many advertisers believe their agencies are bound by duty to look out for their best interest, considering it to be fiduciary and extending past the limiting terms of agency contracts. In turn, some agency executives did share that viewpoint, while many others posited their relationship with advertisers was strictly within the constraints of their contract, further noting there was often a conflict between those obligations they had to their holding companies and their clients’ interests.

In the following articles, you will learn more about the conflicts of interest that can arise within agencies, as well as the solution that can enhance transparency in marketing operations and foster a more trustworthy partnership.