The Federation of Indian Chambers of Commerce and Industry (FICCI) together with Ernst & Young published a 300-page report on current state and future prospects of Indian Media and Entertainment sectors. This article is an overview of trends concerning advertising.

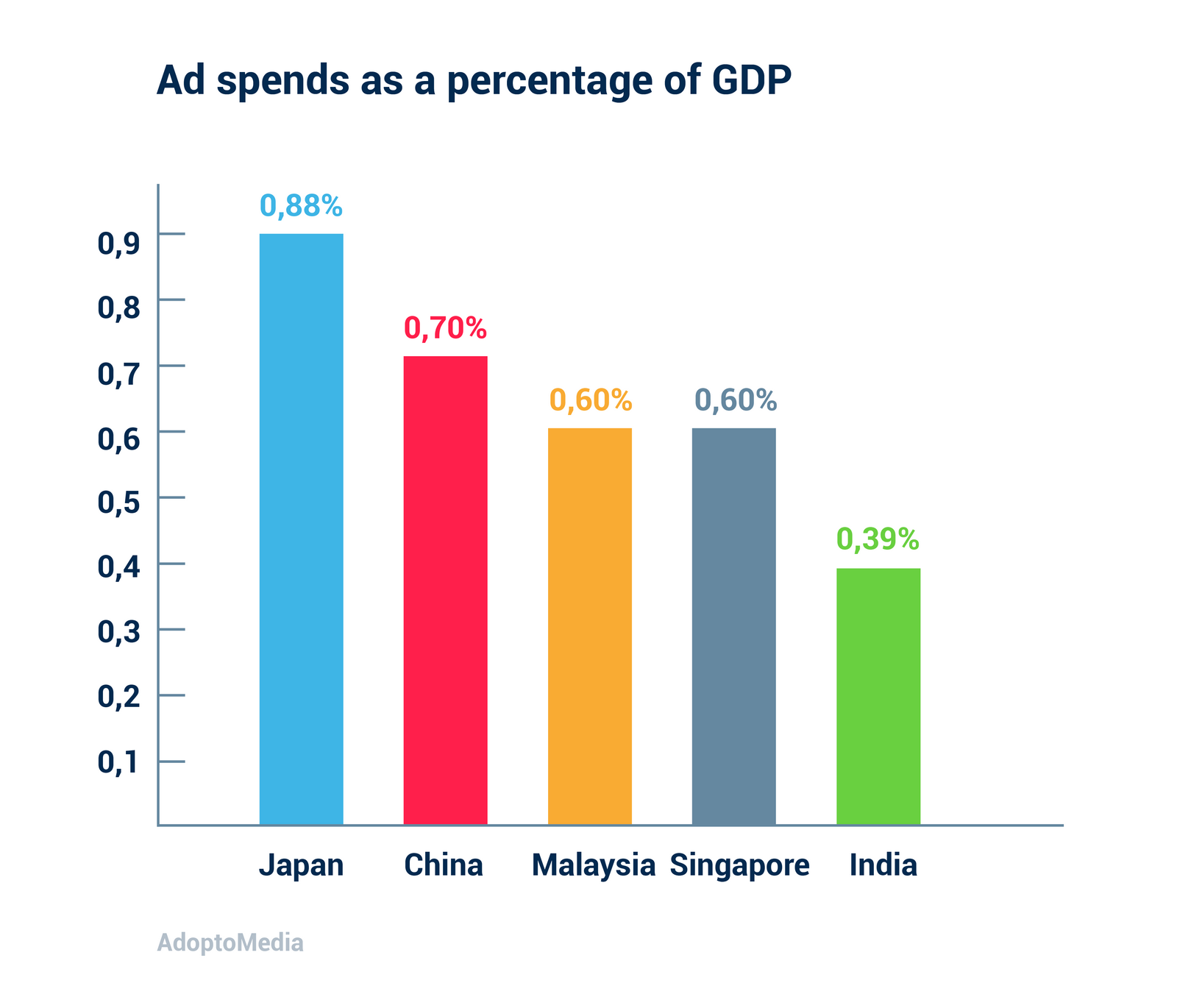

India is a large and fast growing market, in 2014 it surpassed the United States, the EU, and China in terms of real GDP growth and has been steadily maintaining such level ever since. When it comes to media market, it’s a very diverse and the fastest growing sector of Indian economy that attracts a lot of investors. And the most effective sphere of M&E that provides major part of the revenue is advertising, which is expected to grow even more in the upcoming years. If we compare the Indian ad spend in terms of percentage of GDP to that of other large economies, we’ll see that India spends about twice less money on advertising than Japan or China, so there is room for a considerable growth.

On the whole, there is a clear shift towards digital channels, which now account for 21% of all ad spends in India. And the figure will go up when more safety measures are in place to prevent digital ad fraud. Common fraud cases include fake impressions, click farms, ads that aren’t viewed or viewed incompletely while they play, incorrect audience profiling, and bot-based traffic. Despite the risk many companies still invest in this channel because an increasing number of customers is getting digital subscriptions. India actually is the second largest country in terms of internet users after China, with about 570 million subscribers. Even small and medium enterprises (SME), that traditionally promote their goods and services in local newspapers, yellow pages and OOH, allocated a significant share of their media budget to digital platforms like Facebook and Google. According to Forrester analytics the industry will lose as much as US$10.9 billion by 2021 because of fraudulent ads worldwide. But the good news is that blockchain technology provides an opportunity to prevent frauds and increase ad effectiveness. It can also be applied in automation processes and solve some transparency issues, which is still relevant after the 2016 scandal that drove a wedge between advertisers and agencies.

On the whole, there is a clear shift towards digital channels, which now account for 21% of all ad spends in India. And the figure will go up when more safety measures are in place to prevent digital ad fraud. Common fraud cases include fake impressions, click farms, ads that aren’t viewed or viewed incompletely while they play, incorrect audience profiling, and bot-based traffic. Despite the risk many companies still invest in this channel because an increasing number of customers is getting digital subscriptions. India actually is the second largest country in terms of internet users after China, with about 570 million subscribers. Even small and medium enterprises (SME), that traditionally promote their goods and services in local newspapers, yellow pages and OOH, allocated a significant share of their media budget to digital platforms like Facebook and Google. According to Forrester analytics the industry will lose as much as US$10.9 billion by 2021 because of fraudulent ads worldwide. But the good news is that blockchain technology provides an opportunity to prevent frauds and increase ad effectiveness. It can also be applied in automation processes and solve some transparency issues, which is still relevant after the 2016 scandal that drove a wedge between advertisers and agencies.

Social media and search advertising are the major digital ad channels, accounting for 54% of all digital media spendsin India. But e-commerce platforms like Amazon are becoming increasingly popular because that’s where you are likely to reach the largest group of customers interested in purchasing, hence the effectiveness of placing search ads this medium. Currently e-commerce is responsible for 19% of total digital media spends in India, and by applying analytics and getting access to purchasing trends Amazon, Flipkart, Snapdeal and other e-commerce platforms are securing their advertising revenue growth for the next couple of years. In the US, Amazon is planning to challenge Google and Facebook’s domination of the digital advertising sphere by doubling their revenue share in 2019.

Another trend in digital sphere is the rise of OTT platforms both local and foreign, which provide so valuable nowadays direct-to-customer (D2C) capabilities. OTT enables to gather customer data, create programmatic and personalised or addressable advertising with the help of AI algorithms, eventually leading to higher ROMI. Programmatic advertising allows marketers to purchase digital ad spaces automatically on numerous websites with targeted placements and pricing based on demand and supply; it grew from 10% of total digital spends in 2017 to around 20% in 2018 and the figure might increase to up to 50% by 2021. Creating customer profiles is actually the key ingredient in McKinsey’s recipe of a Next-Generation ROMI optimization. With more qualitative data advertising is becoming more effective, so the ability to access personal data and interact with consumers is a crucial element of success. Which is why media companies started to gather customer data in 2018 through second-screen interactive propositions, polls, house-to-house surveys, and integration of third-party data. Companies like Star, Sony, Viacom and Jio successfully implemented second screen interactivity trying to engage consumers, as a result they achieved growing subscription numbers and app downloads among OTT users.

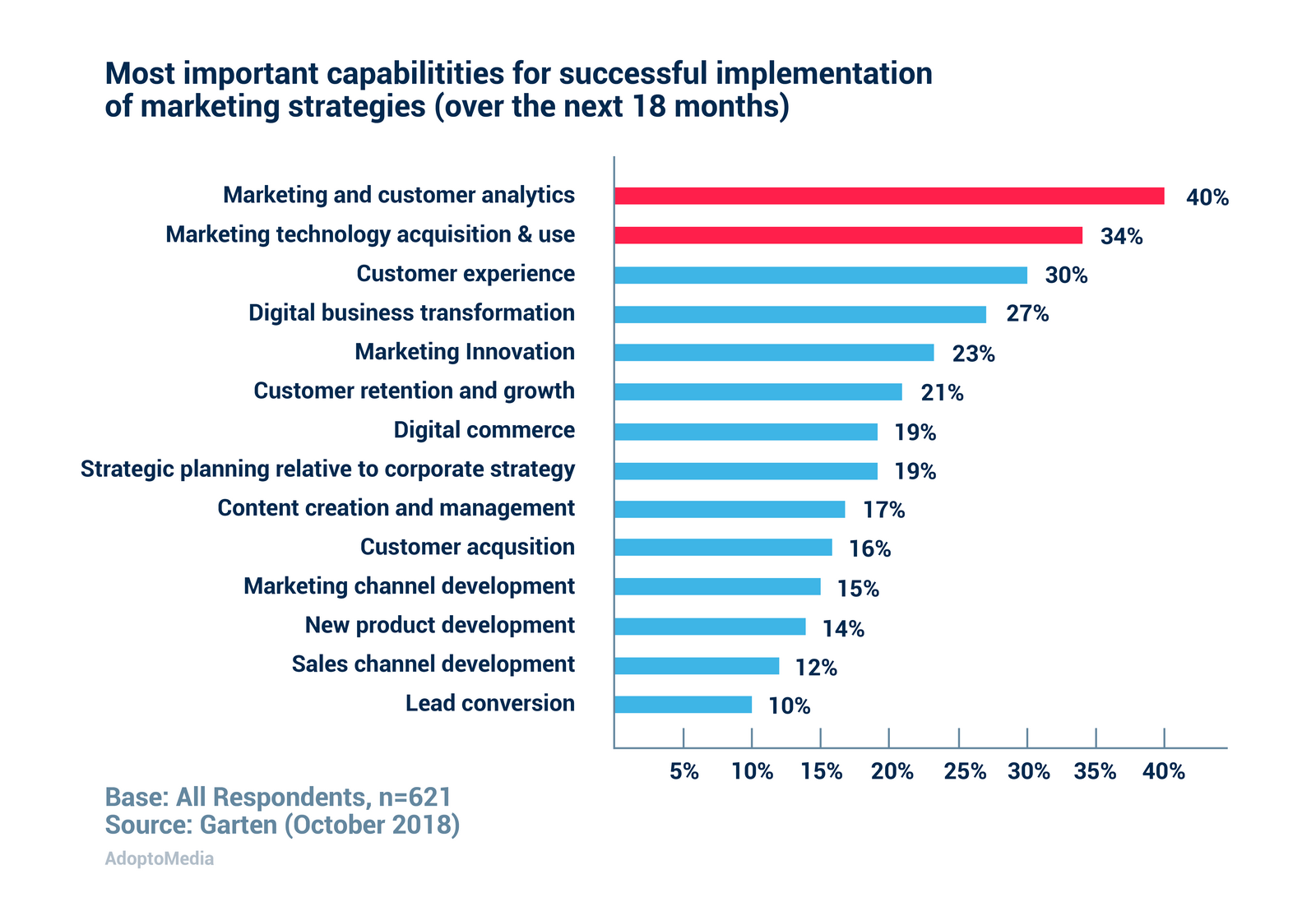

We should also point out that marketing technologies (MarTech) have attracted increasing amount of investments, accounting for the major share of CMO’s expenses in 2018. This happens because both advertisers and agencies are implementing new technologies to get a complete view of their customers through increasing marketing reach, better segmentation, identification of new trends or patterns.

And vital MarTech capabilities for CMOs according to Gartner’s survey results are marketing and customer analytics and MarTech acquisition that are followed by customer relationship management, marketing automation, data visualization and integration, content personalization and engagement, conversational marketing (chatbots), predictive analytics, event tracking, social media monitoring, video marketing and then other AI initiatives.

And vital MarTech capabilities for CMOs according to Gartner’s survey results are marketing and customer analytics and MarTech acquisition that are followed by customer relationship management, marketing automation, data visualization and integration, content personalization and engagement, conversational marketing (chatbots), predictive analytics, event tracking, social media monitoring, video marketing and then other AI initiatives.

In another survey with marketers, improved measurement systems, higher ROMI and D2C capabilities were chosen as top-priority in 2019. Implementing cross-platform measures is necessary, because customers consume content seamlessly across online and offline media channels, but doing it an industry level is a challenging task, with platform fragmentation and numerous measurement agencies, that often contradict each other.

In another survey with marketers, improved measurement systems, higher ROMI and D2C capabilities were chosen as top-priority in 2019. Implementing cross-platform measures is necessary, because customers consume content seamlessly across online and offline media channels, but doing it an industry level is a challenging task, with platform fragmentation and numerous measurement agencies, that often contradict each other.

Another innovation concerns the evaluation of advertising campaigns. Advertisers have started demanding to estimate the effectiveness not by the ad reach but rather by its performance. This change is a result of fraudulent ads, use of ad-blocking programs and brand safety concerns.

As for other advertising channels like TV, radio and OOH, they also showed growth in revenue, even though not so significant compared to digital. Only print media saw a 1% decrease in ad volume. OOH is a popular medium for promotion of retail, consumer services and real estate with ads placed in metros and airports. And 50% of TV ads are devoted to fast moving consumer goods (FMCG).

We should also point out some changes that go beyond specific media channels and concern the whole industry. One of such changes is the appearance of in-house agencies, with 17% of surveyed marketers already having and 31% considering in-house digital media departments. By doing so advertisers can save in agency commissions. One of the world’s largest advertiser Procter&Gamble also set up their own agency as a part of a new marketing strategy aimed at reducing spendings and enhancing the effectiveness of advertising. which they developed in the wake of the transparency scandal. As a result, they managed to save $750 million in 2017. But according to the In-House Agency Forum (IHAF) and Forrester Research, agencies still have the upper ha when it comes to technological capabilities and broader and deeper insights, not limited to one brand. This situation should encourage agencies to reconsider their digital media strategy and approach to managing digital spends. The authors of the report suggest that Indian agencies should provide consulting services on their offers, combining advertising, consulting and technology. That’s actually exactly what leading ad agency networks worldwide including Accenture and PwC do. This will require a lot of changes like marketing automation, after sales service, customer data management, loyalty programs and more.

Another worth noting tendency of 2018 is that parent companies andre trying to centralize the work of their subsidiaries, including such processes as media buying and monitoring. This trend is not only expected to continue, but according to a leading digital advertising agency PwC it is a key to staying competitive, reducing costs and meeting clients’ demands. They offer a four-step roadmap on how to gradually perform this structural reorganisation and transition to the next-generation agency model.

Adoptomedia offers an innovative technology for marketers of large B2C companies that sell products in different regions and promote them through various media channels. CheckMedia Solution is a Media Mix Tool combined with Media plan Manager, it can help you strategically and tactically by creating a smart media budget, setting up media biddings, automating marketing processes and many more. Deploying CheckMedia Solution will result in at least 10-20% ROMI increase.